Introductio

In the digital age, the world of finance has undergone a revolution with the advent of cryptocurrency. Cryptocurrency, often referred to as digital or virtual currency, utilizes cryptography for security and operates on a decentralized network, typically based on blockchain technology. This blog aims to provide an overview of the basics of cryptocurrency, helping newcomers navigate this fascinating and dynamic space.

Understanding Cryptocurrency

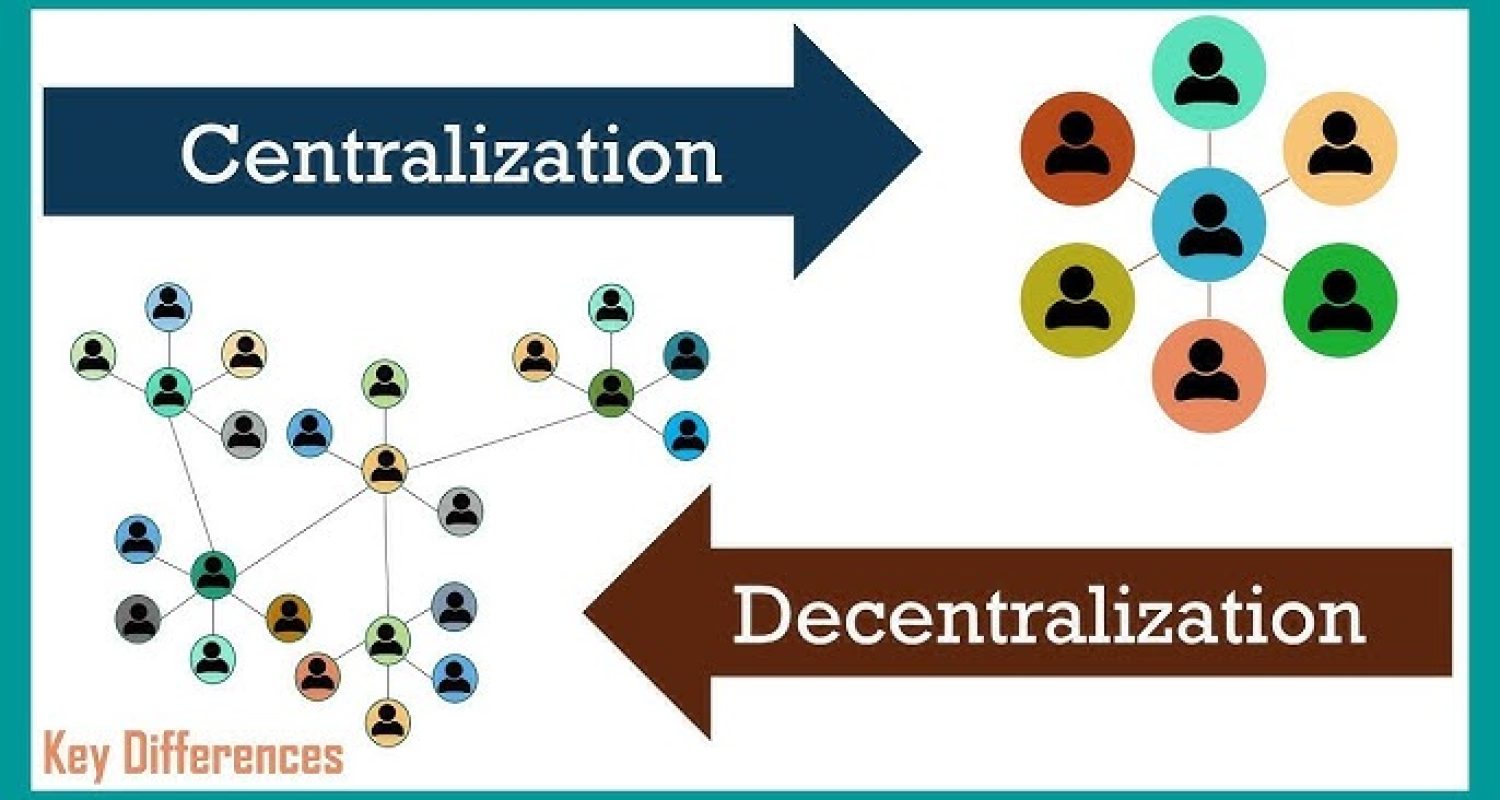

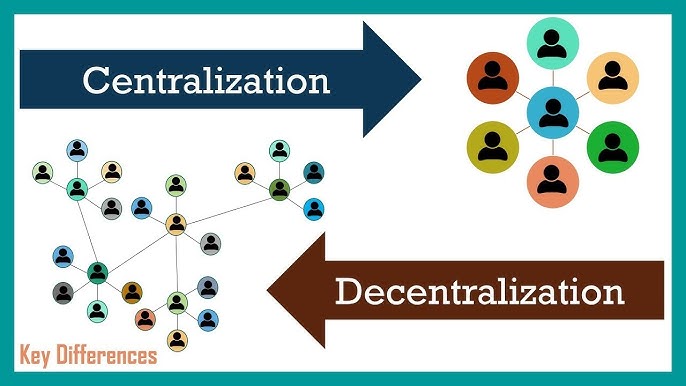

Decentralization and Blockchain Technology:

At the heart of cryptocurrency lies decentralization. Unlike traditional banking systems, which are centralized and controlled by a central authority, cryptocurrencies operate on decentralized networks. Blockchain technology, the underlying architecture of most cryptocurrencies, is a distributed ledger that records all transactions across a network of computers. Each block in the chain contains a list of transactions, and once a block is completed, it is linked to the previous one, forming a secure and tamper-resistant chain.

Cryptographic Security:

Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. Public and private keys are integral components of this security system. The public key, known as the wallet address, is shared openly, while the private key is kept confidential. Transactions are verified through these keys, ensuring the integrity and authenticity of the digital assets.

Digital Wallets:

To engage with cryptocurrencies, users need a digital wallet. This wallet stores the public and private keys, allowing users to send and receive digital currency. Wallets come in various forms, including online wallets, mobile wallets, hardware wallets, and paper wallets. Each has its advantages and considerations in terms of security and convenience.

Mining and Consensus Mechanisms:

Cryptocurrencies are often created through a process called mining. Mining involves solving complex mathematical problems, validating transactions, and adding them to the blockchain. This process helps maintain the integrity of the network and ensures that all participants agree on the state of the ledger. Various consensus mechanisms, such as Proof of Work (PoW) and Proof of Stake (PoS), govern how consensus is achieved in different cryptocurrencies.

Popular Cryptocurrencies

Bitcoin (BTC):

Bitcoin, created in 2009 by an anonymous person or group known as Satoshi Nakamoto, is the first and most well-known cryptocurrency. It paved the way for the entire industry and operates on a PoW consensus mechanism.

Ethereum (ETH):

Ethereum, introduced in 2015 by Vitalik Buterin, goes beyond being a digital currency. It enables the creation of smart contracts and decentralized applications (DApps) on its platform, using a PoW mechanism transitioning to Proof of Stake (PoS).

Ripple (XRP), Litecoin (LTC), and Others:

Numerous other cryptocurrencies serve various purposes, such as Ripple for facilitating cross-border payments and Litecoin as a faster alternative to Bitcoin. Each cryptocurrency has unique features and applications.

Risks and Challenges

Volatility:

Cryptocurrency prices can be highly volatile, leading to significant value fluctuations within short periods. Investors should be prepared for price swings and conduct thorough research before investing.

Regulatory Landscape:

The regulatory environment for cryptocurrencies varies globally. Regulatory changes and uncertainties can impact the market and user experience.

Risks and Challenges (Continued)

Security Concerns:

While the blockchain technology underlying cryptocurrencies is considered highly secure, other elements in the ecosystem may be vulnerable. Hacks and security breaches have occurred, leading to the loss of funds. It’s crucial for users to prioritize security measures, such as using reputable wallets, employing strong passwords, and enabling two-factor authentication.

Lack of Regulation:

The decentralized nature of cryptocurrencies can be a double-edged sword. On one hand, it provides users with financial autonomy, but on the other, it can lead to misuse and illicit activities. The lack of regulation has been a concern for governments and regulatory bodies, and it may affect the widespread adoption of cryptocurrencies.

Future Trends

Increased Adoption:

Cryptocurrencies are gradually gaining acceptance in mainstream finance. Major companies and institutions are exploring ways to integrate blockchain technology and digital assets into their operations. This increased adoption could contribute to the legitimacy and stability of the cryptocurrency market.

Development of Central Bank Digital Currencies (CBDCs):

Several central banks are exploring the creation of their own digital currencies. CBDCs could provide a government-backed alternative to decentralized cryptocurrencies, maintaining regulatory control while incorporating the efficiency and security of blockchain technology.

Technological Advancements:

The cryptocurrency space is dynamic, with ongoing technological advancements. Projects are continuously developed to address scalability issues, enhance privacy features, and improve the overall user experience. Keeping abreast of these developments is crucial for those involved in the cryptocurrency space.

Getting Started with Cryptocurrency

Educate Yourself:

Before diving into the cryptocurrency market, it’s essential to educate yourself. Understand the basics of blockchain technology, how different cryptocurrencies work, and the risks associated with investing.

Choose a Reputable Exchange:

If you decide to invest in cryptocurrencies, choose a reputable exchange to buy and sell digital assets. Ensure the platform has robust security measures and a user-friendly interface.

Secure Your Investments:

Safeguard your digital assets by using secure wallets, enabling two-factor authentication, and keeping your private keys offline. Be cautious of phishing attempts and scams that target cryptocurrency users.

Start Small:

Cryptocurrency investments come with risks, so it’s wise to start with a small amount that you can afford to lose. As you become more familiar with the market, you can adjust your investment strategy accordingly.

Conclusion

Cryptocurrency is a transformative force reshaping the financial landscape. While it offers exciting opportunities, it’s crucial to approach the space with caution, awareness, and a willingness to learn. As the industry evolves, staying informed about technological advancements, regulatory changes, and market trends will empower individuals to make informed decisions in this dynamic and rapidly changing ecosystem. Whether you’re an investor, developer, or simply curious about the future of finance, the world of cryptocurrency invites exploration and engagement.

#CryptoBasics #BlockchainExplained #DigitalCurrency101 #CryptocurrencyEducation #DecentralizationRevolution #SecureYourCrypto

Thanks & Regards – Seema Kanojiya

Digital Marketer & Blogger

Tagged #BlockchainExplained#CryptoBasics#CryptocurrencyEducation#DigitalCurrency101